Payroll and Tax Processing

Wish There Were a Payroll System That Could Easily Handle Your Needs?

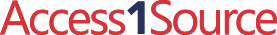

Experience a unique, robust web-based application that simplifies your entire payroll process while ensuring accuracy and providing in-depth reporting options. Our payroll system has been developed to be both easy to use and intuitive for a range of basic and complex scenarios. By performing calculations as you go, along with generating a complete set of more than 60 exportable reports, you’re able to monitor payroll in real time while eliminating the lengthy task of traditional pre-processing. When accuracy counts most, a robust tax engine handles time-consuming tasks, offering automated multistate and reciprocity calculations while a local tax jurisdiction locator suggests applicable taxes. Self-service functionality takes the application one step further by empowering your employees to manage several of their payroll-related tasks, such as direct deposit accounts and tax information.

Application Highlights

- No Traditional Pre-processing

- Security Profiles

- Quick Payroll

- Geospatial Tax Identification

- Reciprocity Automation

- Calculations as You Go

- Robust Reporting

Feature Highlights

Simplicity is at the core of our payroll application. The application offers self-service workflows for employees, managers, and payroll administrators to handle many of their tasks across the functional spectrum.

![]() Security Profiles give you the ability to customize unlimited levels of access, which is particularly important when it comes to sensitive payroll information. The spectrum is virtually limitless: Have your payroll administrator view and edit information while your HR team has view-only capabilities.

Security Profiles give you the ability to customize unlimited levels of access, which is particularly important when it comes to sensitive payroll information. The spectrum is virtually limitless: Have your payroll administrator view and edit information while your HR team has view-only capabilities.

![]() Quick Payroll makes processing payroll a breeze, especially for smaller companies. Quick Payroll links are easily accessible through the navigation bar and, once selected, the payroll entry screen allows the user to enter data into a spreadsheetlike screen for easy data entry, review, and submission of a payroll.

Quick Payroll makes processing payroll a breeze, especially for smaller companies. Quick Payroll links are easily accessible through the navigation bar and, once selected, the payroll entry screen allows the user to enter data into a spreadsheetlike screen for easy data entry, review, and submission of a payroll.

![]() Geospatial Tax Identification is a tool that obtains information directly from local taxing authorities and uses the precise geographic coordinates of an employee’s residence and work address to accurately depict the local taxes that apply for that particular employee.

Geospatial Tax Identification is a tool that obtains information directly from local taxing authorities and uses the precise geographic coordinates of an employee’s residence and work address to accurately depict the local taxes that apply for that particular employee.

![]() Calculations as You Go put an end to the payroll waiting game. No pre-processing steps are needed in order to preview pay statements for employees prior to finalization. This feature provides statements and essential reports in real time, without the need to conduct traditional pre-pay processes.

Calculations as You Go put an end to the payroll waiting game. No pre-processing steps are needed in order to preview pay statements for employees prior to finalization. This feature provides statements and essential reports in real time, without the need to conduct traditional pre-pay processes.

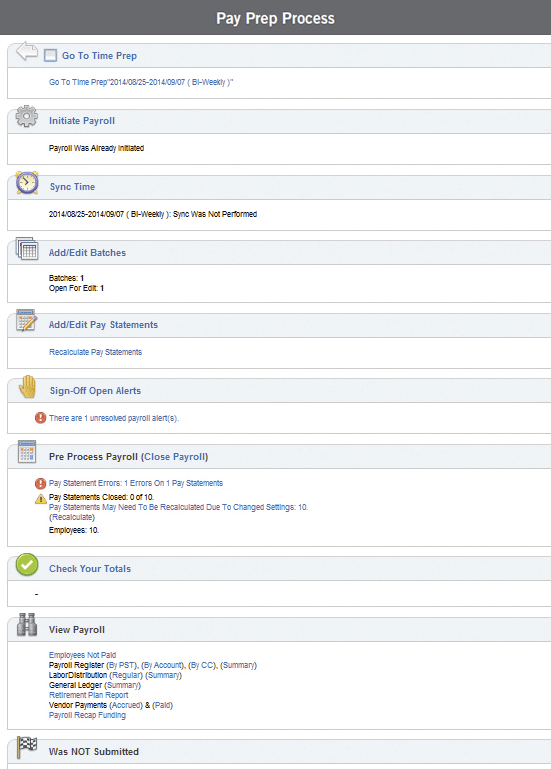

Robust Reporting

There are more than 60 built-in standard reports, and users can also create ad hoc custom reports. Quick Links allow users to swiftly navigate between the most popular reports.

- The General Ledger report provides records — including earnings, taxes, and deductions — that are linked to the proper GL code determined at setup.

- The Payroll Register is the main payroll report that is generated with each payroll processing. This report includes all earnings, taxes, and deductions for all employees in a specific pay period.

- The Payroll Recap and Funding report is also compiled during each payroll processing. This report generates the total dollars and summary breakdown of where funds were spent for that pay period.

Choose from a wide range of export options, including CSV, Excel, PDF, and XML.

Marketplace Add-Ons

This application comes with additional, specialized add-ons within the Marketplace. These powerful tools, enabled for an additional fee, help further streamline business processes and increase security.

- eBenefits Network is a service that automates benefit enrollment data exchange. Benefits deductions and other changes to payroll data are made automatically within the application.

- RSA authentication helps reduce security risk by requiring users to input a unique password and RSA token code before being granted access to the application.

- The workforce management dashboard offers a suite of intuitive, visual reports and useful tools designed for senior and executive team members.

Marketplace offerings are constantly expanding, so please check back as new add-ons are released regularly.

Does your current payroll solution meet your needs?

- Is it robust enough to effectively manage the entire payroll process for my organization?

- Does it offer a wide-enough range of reporting options to allow me to efficiently oversee and manage my payroll?

- Can the functionality expand as I grow my business?

If you answered no to any of these questions, contact us to learn how these solutions will help you say yes.